Marjo Martinez and Taru Eboreime, tripod research oy

Worldwide Readership Research Symposium Valencia 2009 Session 7.5

Background thoughts

For the past 100 years the media world has been obsessed with numbers. The number of eyeballs, ears, people in attendance, contacts achieved. And that is quite understandable. Advertisers need to know how many people their advertisement reaches in any given medium. And since the raise of all the so called new media and the continued fragmentation of audiences these numbers became even more sought after.

Another development that every now and then grips the attention of our industry is the quality of audiences measurements. Media gets enthralled by value studies and media usage motives and the advertisers as well. The people that often do not get so enthusiastic about these studies are the media marketing people. They find them often too difficult to understand or at least present in a way that is easily understandable.

Both the above mentioned approaches have their merits and are needed in their own way. We feel, however, that there was something missing.

A media brand is no longer tightly anchored to just one media channel. Established print media brands are venturing on to the internet and even to TV. Some Media brands have a real life shop selling various merchandise. The brand is out and about and consumers come to contact with it in many ways. Yet there seemed not to be a study available that would measure what kind of an image a brand has among it’s various audiences.

Since we have years of experience of doing many kinds of media related studies (NRS, value studies, media usage motives, advertising…) we started to develop a measurement, that would tell enough of a audience’s mood and relationship with their chosen medium in one simple glance. Tall order, and in no way can we say that after this one pilot study we would have found a solution to all the issues we were trying to address, but we have to say that both we and our client were enthusiastic about the results.

We are most grateful to Yhtyneet Kuvalehdet (www.kuvalehdet.fi) for their decision to let us use their prestigious brand in our pilot study and to allow us to report the results to wider audiences. We hope our study does them and their brand justice. We did not need to do much convincing which shows that they are always vigilant and want to be on the forefront of media research, be it partly experimental or not.

Our approach

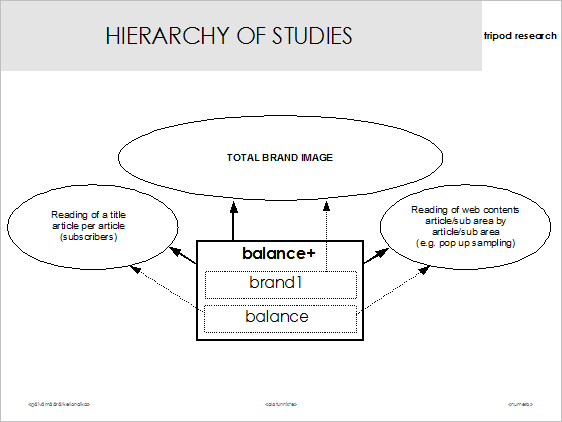

Since we had a rather good method to study how a print title issue is read, called balance, and a similar method was used to survey our case title before, we chose to start with that one. What we needed to develop was a method that approaches a brand from all angles of it’s existence and produces a clear depiction of it’s appearance. After careful consideration we chose to break the execution to three parts

- balance study of the print title

- balance study of the website

- brand1 study of the total brand

When doing both studies at once we call it balance+. The hierarchy of these studies is explained in the following graph.

NOTE The reason why in Finland most reading studies are conducted among subscribers is in the structure of the Finnish media market. Most titles live on subscriptions, both newspaper titles and magazine titles. The largest news stand sale percentages per title vary per issue but usually do not exceed 15%. That means that 85% or in most cases over 85 % of the readership of any issue is made up of subscription based reading.

Balance is based on a ”page traffic” kind of measurement of a title’s one issue’s entire journalistic content. Balance studies usually also contain a small section of statements relating to the title brand and the perception of the respondents.

As a media brand one has to remember that its backbone is always the contents on offer. Content is king, so to say. Therefore it is necessary to find out how well the total audience and all the sub-audiences feel they are catered for. And that is the clue behind our balance study. Before you can have a strong brand as such you have to have a strong offering.

In a balance study the respondents are asked first about the cover of the issue (what looks most enticing, how did it deliver the contents they were expecting). Then they are asked about all the journalistic content, whether they read it or not and if they read it what was their perception of the quality of the piece. The quality is measured in relation to the title. In some publications the best quality attribute is usefulness, in others entertainment value. In our pilot case we decided to go with “how interesting” the readers had found the article.

We applied the same method to studying a website. That posed some initial difficulties, which we had to overcome.

The first obstacle is the fast pace of adding new content to a website. The whole nature of a media website is that it provides new content all the time. However, it is impossible to measure the readership of an article and then give a response as to how large a proportion of the audience read it AND compare that to some other article if the contents and offering is constantly changing. In our pilot case we were pleased that the website in question was a slow paced one to begin with (new content daily, but in moderation). The method is usable in context with a faster paced website as well, it just cannot be as detailed but more on the level of sections and the number of articles read from a section or area.

The second obstacle was that there was no previous figures to compare the results with. Comparing them to the results of a printed title is not an option. So to start with we had no idea what kind of results we were likely to get.

brandl is the name of our total brand measurement. The idea is that we measure certain attributes in all the various audiences, in this case the two audiences: the print title audience and the website audience.

The aspects of a brand image vary from one brand to the other. Some print titles are more entertainment oriented, others offer hands on practical advice. Some are more international, others get their strength from being down to earth and domestic. The same goes with other than media brands. They especially have many different audiences who come to contact with the brand in a large variety of ways. With brand1 we could measure what is the value of a customer magazine vs. the value of a website vs. the value of customer helpline to a brand. The possibilities are limitless.

In our pilot case the fieldwork of our brand1 was done together with balance -measurements. It is possible to do brand1 also as a stand-alone study.

The case

Our case was Kotiliesi, which has a measured circulation of 148 000 and 465 000 readers according to the latest available NRS measurement (2008). The profile of this bi-weekly magazine is 80% female and 65% of all readers are over the age of 50. The mood of the readers is more practical than glitzy. The articles are usually about interesting people, rather more domestic than foreign focus and a lot of food and housekeeping advice. The magazine has started already in 1922 and has been a beacon for family oriented women over the years.

The Kotiliesi website has a similar offering to the print title in that it focuses on practical advice on food and drink, organising parties and coping with everyday housekeeping activities. There is also a strong emphasize on culture in the form of book reviews. Where the two differ is the absence of people oriented articles and interviews from the website.

In a case like this there is a clear need to find out whether the old and well established print brand has been successfully brought to the new medium of internet. The interest is both from the publisher’s side to see how well they have done and also from the advertisers side to see if the audience reached via the internet site differs from that they are used to reaching via the print title.

Most readers of the printed title are over the age of 50 and many of those over the age of 65. The use of internet in the core readership demographic has been lacking behind compared to the public in general up to recent years. These days, however, most Finns even in the older demographics are using the internet on a regular basis.

Fieldwork

The fieldwork period for the case was in May 2009.

We surveyed Kotiliesi 9/2009 (issued 17 May). The necessary recruitments were done 17. – 19.5. and the actual fieldwork period for the print title was 18. – 25.5. By the end we had 52 respondents that took the postal questionnaire option and 260 respondents that replied to us via an internet questionnaire (total was 312 respondents).

The oldest and youngest demographics in the print title audience were recruited by additional phone calls. This was to make sure that even those older respondents to whom internet was not an option were represented in the study. Also we wanted to make sure that there were enough of the under 35 year old respondents. For most of the print title fieldwork we just sent out an email invitation to take part in the study after they had read the issue in question.

The Kotiliesi website was ”frozen” for a weekend around the same period. The fieldwork was conducted 22. – 24.5. during which time no new content was added to the site. The total number of respondents recruited by a pop up on the site was 176.

balance results; print title

The results of the case were presented in the same three sections mentioned on page 2.

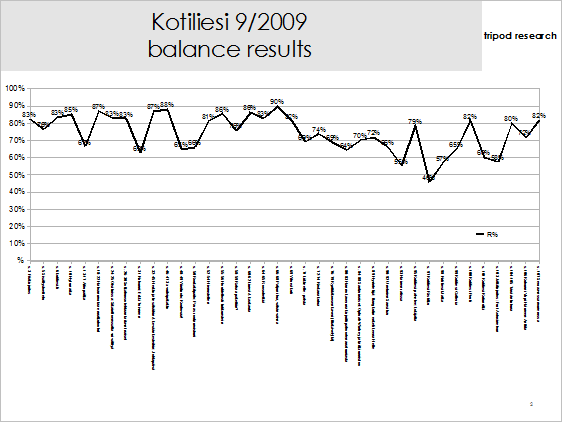

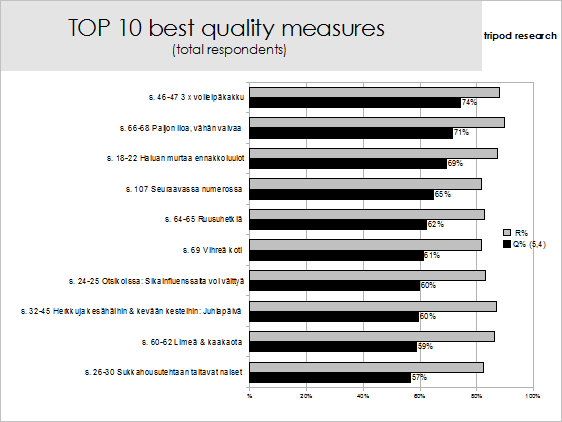

The results of the print title balance study were phenomenal. The average percentage of readers that read any of the articles measured was 77%. It is not usual to get this high figures overall in most cases. Some titles that have teenage or young women as their core demographic can however reach such figures consistently.

The previous results of similar studies for Kotiliesi had been a little lower, but also on the high side. We knew that the audience had a good strong relationship with their title of choice.

In some other titles we have measured the results are nowhere near this good. The results act then as a good basis for making adjustments in the offering. If the offering is not strong enough it can not produce a strong brand image either, no matter what kind of an image the publisher is trying to achieve.

When interpreting the results it is important to look beyond the overall results and see how the various sub-audiences read the title. Sometimes it is not at all meant that all articles appeal to all members of the audience. Sometimes there are surprises when sections of a title are not read by those that they were intended to but that a whole other part of the audience has taken to them.

A useful way to look at the results is also the portfolio of themes that the journalists can draw from when compiling an issue. This decreases the number of variables in an analysis so that it is easier to see what kind of themes are well received and which fall short of expectations.

There are several ways to rank the themes and articles to get to the bottom of what appeals to each sub-audience. In our pilot case a total 39 articles and columns were measured.

Some articles or columns that were not even aimed at all readers (e.g. women drivers column) got a little lower readership figures, but the lowest figure on total level was 46% which is really not that low.

Some articles or columns that were not even aimed at all readers (e.g. women drivers column) got a little lower readership figures, but the lowest figure on total level was 46% which is really not that low.

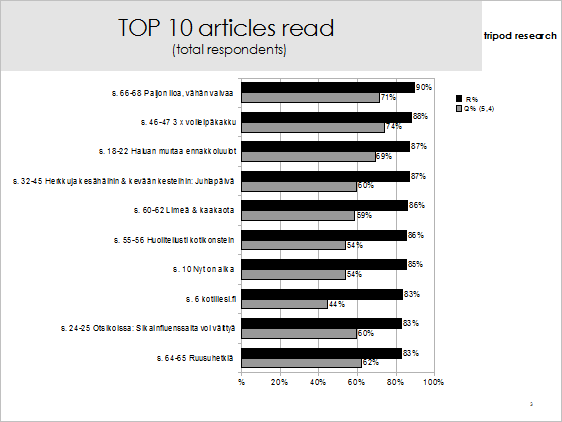

90% of all respondents read or glanced through the article on pages 66-68 which was about a fantastic looking but low maintenance garden.

The second most read article was a hands on tutorial into making savoury cakes. The article gave three varying recipes. 88% of all respondents read that.

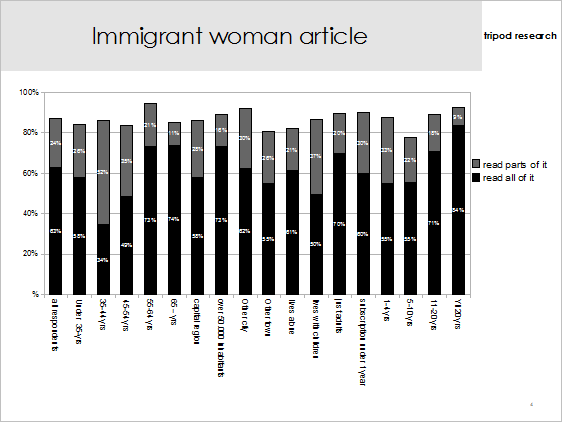

The third most read article was about the immigrant woman of the year, a 23-year old Kosovan that came to Finland at the age of 7.

Each article or column was carefully evaluated so that each demographic and subscription age group was looked at. In this example the article about the immigrant woman and her life with the two footballer brothers and a sister was very well received in the older age groups. Total percentage of respondents that read the article are however equally high in all age groups.

Each article or column was carefully evaluated so that each demographic and subscription age group was looked at. In this example the article about the immigrant woman and her life with the two footballer brothers and a sister was very well received in the older age groups. Total percentage of respondents that read the article are however equally high in all age groups.

The article that was second most read got the highest quality evaluation. The chosen quality measure was ”found the article interesting”, even though it might have been something else for the more practical articles like the food articles. However it is usually best to refrain from using more than one quality measure if at all possible, since it is likely to cause confusion when interpreting results.

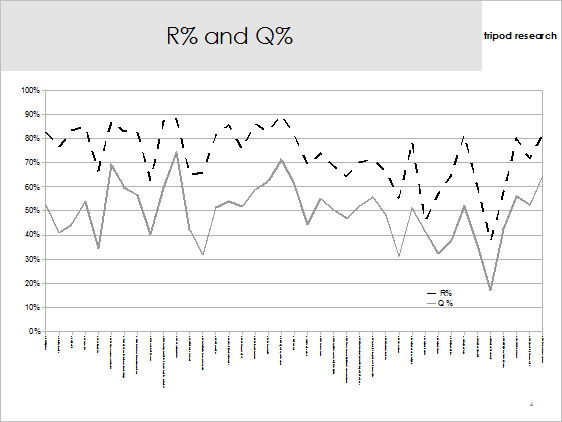

The quality measure followed the reading measure closely in this survey. As quality measure we took the top two of a five point scale (totally agree, agree).

The quality measure followed the reading measure closely in this survey. As quality measure we took the top two of a five point scale (totally agree, agree).

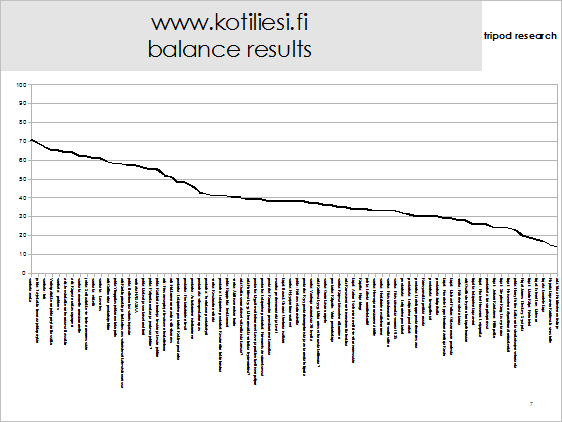

balance results; website

As mentioned before the website was measured the same way as the print title. Altogether 76 different articles were taken into the study. We have to keep in mind that on top of the now measured 76 there are hundreds of articles and recipes to be read every day on the website. Therefore we consider the results of this survey to be rather excellent.

The most read articles were all related to food in some way. Since the fieldwork period was in May a lot of the traffic on the web page was to find practical advice to graduation parties. Graduation from lukio (the Finnish high school) is a big thing in all families and annually there are some 30 000 graduates, all on one day at the end of May.

The average percentage of respondents to read an article that was included in the survey was 41%. Considering that we actually measured twice the amount of contents on the website compared to the print title the result is excellent.

There are differences in the results the same way as on the print side depending on the sub-audience in question. We do not go into them in detail at this point.

balance+ results; total brand measurement with brandl

We knew after completing the two balance surveys, that the relationship between the readers and the print title as well as the website was strong. What remained to be seen was which aspects of the brand image were the ones most contributing to this and if they were the same for both audiences.

Having completed the two balance studies we can also see how they act as a “casting director“ assigning strengths to each media channel. It is easy to see how much more appealing a practical approach is to the web audience and how the print audience wants to read in depth interviews on top of the practical advice on offer.

In brand1 we try to look at the brand variables from two angles to make up a holistic view. If there would be a third outlet for the brand (e.g. A TV-show) we would survey that audience as a third angle. There is naturally some overlap, some print title readers visit the website as well and some website visitors were also subscribers of the print title. The overlap was not however so large, that it would have made it futile to complete our exercise.

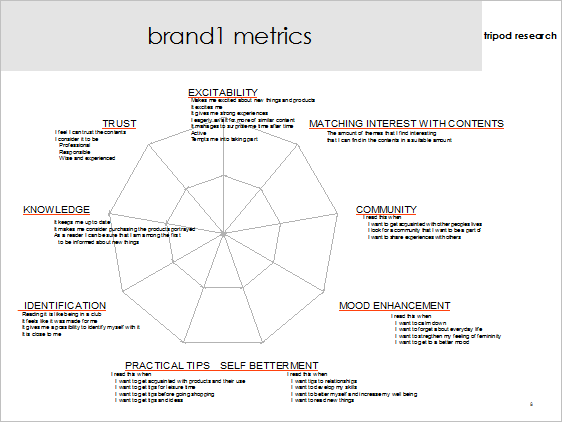

To get this holistic view we had some behavioural metrics (read text throughout or partly = R%) and a measure of the experienced quality (5, 4 of scale 5-1 = Q%). To get more of a mood and motive based idea of how the audiences perceive the brand we combined the following metrics from a list of media usage motives and a list of attributes accredited to the brand.

NOTE that this title is not at all glitz and glamour oriented, so all attributes relating to such were omitted. There are titles where some of the metrics used in this case would not yield a good or relevant result. Escapism or entertainment attributes and motives were not even considered here, since the title surveyed is more down to earth and celebrating the normal family life and not the life of celebrities.

The nine features were considered relevant to this title in some way. They were combined mainly from metrics that were already in use in previous studies. Since there already was a list of attributes measuring the reader relationship we merely made some small additions to it and used them as part of these metrics. The same applies to the motives. Some motives were already on the previous questionnaires, we added some to them and used them in these metrics. Only the adjectives list was a new introduction to this study. Thus e.g. the TRUST feature is a combination of two different measures: an adjectives list and attribute list and the COMMUNITY feature is derived from the motives list alone.

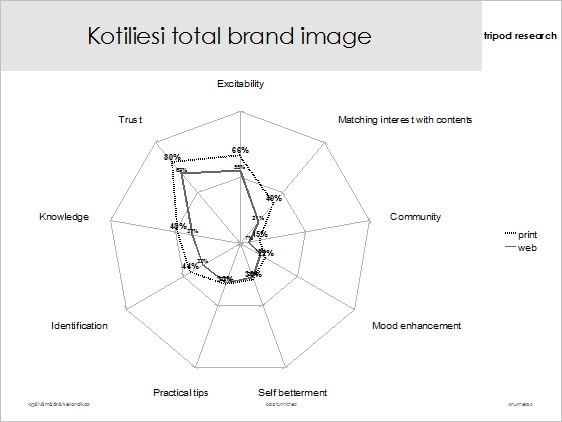

The main result is in the following graph. The highest feature of the total brand image is TRUST. 80% of all those who approach the brand from the print side have a trust in the brand. The second highest feature is EXCITABILITY, 66% of those approaching the brand from print side are excited about the brand. Both these features are less prominent in the audience that approaches the brand from the website. However, the big picture is the same shape for both audiences.

NOTE that this does not tell of how the print readers relate to the print title and how the web audience relates to the website contents but how these two audiences perceive the total brand of Kotiliesi, regardless of which form it takes.

On features PRACTICAL TIPS and SELF BETTERMENT the brand identity is the same regardless of from which side the audience comes from.

On features PRACTICAL TIPS and SELF BETTERMENT the brand identity is the same regardless of from which side the audience comes from.

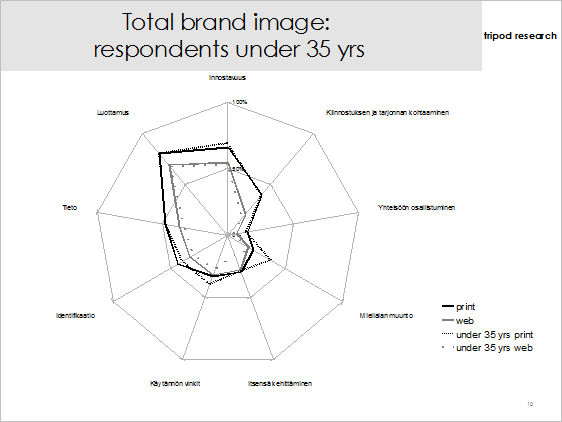

These two are the features where the web audience in some subgroups even surpasses the print audiences result, like here in the age group under 35 yrs.

The TRUST feature gets it’s highest values from those who approach the brand from print side and live in cities that have over 50 000 inhabitants (ex cl. capital area and Turku/Tampere). The same people give an above average result on MOOD ENHANCEMENT feature.

Capital area (Helsinki, Espoo, Vantaa) is in all aspects of this study a critical and challenging target market. About one in five Finns lives in this area, so it goes not to leave them outside. However, thee mood of the people is quite different in this area compared to the rest of the country. They tend to be more materialistic in their values than the rest of the country and also modern values are more prevalent there. Therefore it is rather natural, that Kotiliesi as a traditional women’s home and family oriented brand does not strike high scores where people are more career and friend oriented.

Only some years ago internet was seen as a brand extension but these days it is part and parcel of the brand as a whole. We are not at liberty to tell you which of the Kotiliesi sub-audiences have already adopted internet into the brand as strongly as they feel about the pint title. The results are clear and tell the publisher exactly who they need to target to get the rest of the audience on board. That was one of the aims set for this whole case and we feel that it was met.

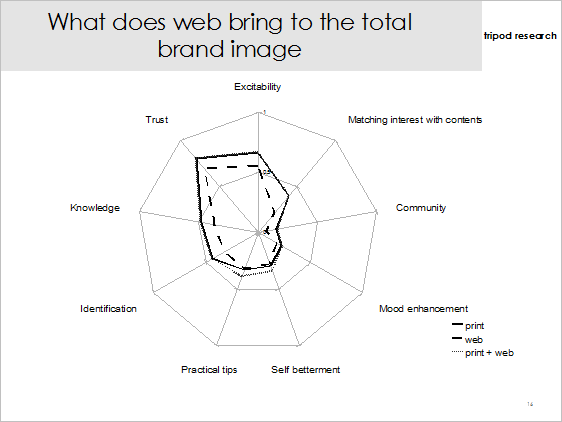

When adding the effect of web to the result of print brand image we can clearly see, that the features that the web is strongest at and adds to the picture are PRACTICAL TIPS and SELF BETTERMENT. Both of these are aspects, that are also very marketable.

When adding the effect of web to the result of print brand image we can clearly see, that the features that the web is strongest at and adds to the picture are PRACTICAL TIPS and SELF BETTERMENT. Both of these are aspects, that are also very marketable.

The print+web figure has been calculated by taking the print readers evaluations and adding the evaluations they have given also of the web side of this brand.

It will be interesting to see these same calculations of different kinds of brands.

Total brand measurement results in media sales

It is important to understand the total brand image when dealing with the delicate business of managing the contents and offering, any editor will tell you that. It is however far less talked about among those who sell media space. That is where reach and cover percentages rule.

It might be tempting to take the good results of balance studies to the media sales department as they are. What would be easier than selling advertising to a theme that is most interesting to the audience and one that most members of the audience read all through. That is a risky idea, since pretty soon the sales department would be in a situation where advertisers would demand a lesser price for advertising space that is in a section that is of less interest or less read. And that is not what publishers want or should want.

Introducing a total brand image result into media sales is challenging, and we are not in a position to tell how it went in this case. Mostly since the results are still so fresh that there simply has not been enough time at this point to see how it will be adopted. What we can tell you, are the ideas that we had in our mind when starting the project and which we still feel should work very well.

In the study we had also a long list of themes, that are possible in this title. We looked at them very carefully for the balance part of the results. We looked at the themes that the readers wanted more and the reading of articles that actually were on offer in that theme category. Some of the themes are both commercial and editorial, some purely editorial. All the purely editorial ones can be overlooked in this context (e.g. in depth interviews of interesting people, domestic).

The results bring to light several cross sales themes, where the web can drive traffic to the print title and vice versa. This works both for the journalistic and commercial content.

There have been several doctoral thesis written on the way a person processes advertising. One factor proven to have significant effect is the medium itself and the perception it’s audience has of it. In our pilot case we aimed to prove that a study like this can uncover brand attributes that help advertisers trust the media environment and thus aide media sales.

Trust is one of key features in this sense. If the audience feels a media brand to be worthy of their trust, some of that trust is automatically transferred to the brands advertised in that medium. And in our pilot case we got very high results on TRUST

feature. As a matter of fact it is very difficult to imagine that they could be any higher. Therefore we could see Kotiliesi media sales using that feature alone as a powerful sales tool.

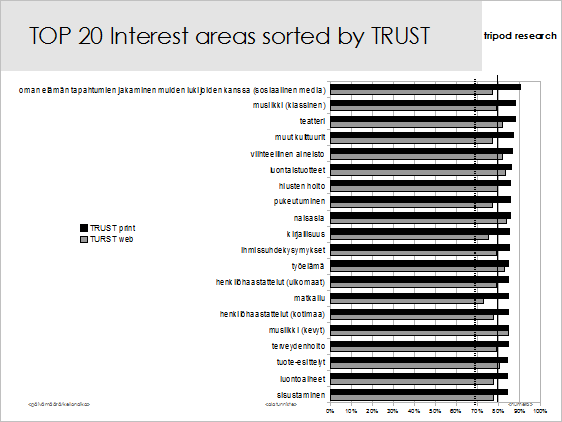

Those interested in classical music and those interested in pop music both score above average on TRUST. It is therefore easy to see that music companies should advertise in this medium, since it is far more likely that they would be taken seriously by the target audience in this than some other medium. The same goes for hair care and clothes, those interested in either one score very high on TRUST feature. In actual fact the whole TOP 20 interest areas score above average.

Those interested in classical music and those interested in pop music both score above average on TRUST. It is therefore easy to see that music companies should advertise in this medium, since it is far more likely that they would be taken seriously by the target audience in this than some other medium. The same goes for hair care and clothes, those interested in either one score very high on TRUST feature. In actual fact the whole TOP 20 interest areas score above average.

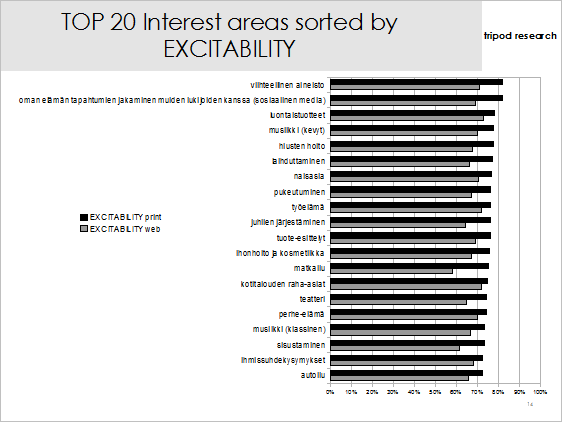

Another easily marketable feature in any media environment is the brand’s ability to excite it’s audience. If the media can provoke positive excitement that too can to some extent transfer onto the brand being advertised.

In Kotiliesi audience EXCITABILITY was something that was also strongly identified as a part of it’s total brand image.

In Kotiliesi audience EXCITABILITY was something that was also strongly identified as a part of it’s total brand image.

What is somewhat surprising to see though, is that those interested in entertainment contents gave the highest scores on EXCITABILITY.

We must remember, that entertainment value in this context is quite another thing from the entertainment value of the contents in magazine brands like Hello! Magazine or US Weekly.

However, if Kotiliesi can excite it’s audiences, both on print and on line, that can easily be transferred onto the dieting aids advertised there, since those in the audience interested in dieting are one of the groups most excited by this brand.

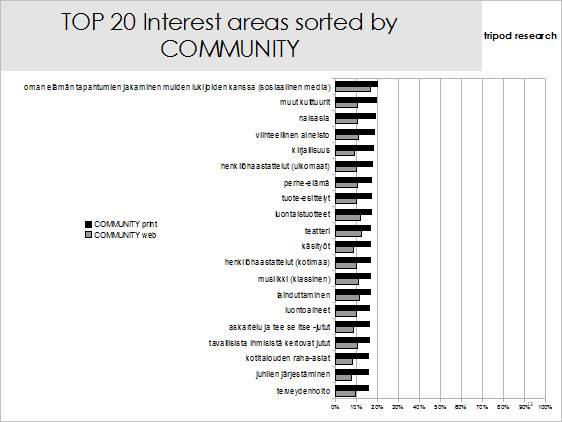

COMMUNITY is a concept that is very difficult to survey when Finns are in question. The whole idea of sharing your life with others might be embraced – like it is embraced in Kotiliesi audiences in real life – but for Finns to understand that that is what they are doing is still some time off.

Therefore even if there is a website under the same brand name as an established print title and even though trust in the brand is high and even though the audiences take part in all kinds of competitions and share pictures of their gardens and pets and comment on each others pictures they STILL do not consider that they are taking part in any kind of community activity. This kind of result is all too common in Finland these days and all researchers are struggling to find the terminology that would make the population give the response to a question on a questionnaire that actually portraits their activities more closely.

Therefore even if there is a website under the same brand name as an established print title and even though trust in the brand is high and even though the audiences take part in all kinds of competitions and share pictures of their gardens and pets and comment on each others pictures they STILL do not consider that they are taking part in any kind of community activity. This kind of result is all too common in Finland these days and all researchers are struggling to find the terminology that would make the population give the response to a question on a questionnaire that actually portraits their activities more closely.

There are altogether 36 interest areas in this study. They give the people selling media space a lot to work with. There are some rather interesting results there too. Even though the percentage of people interested in cars in the audience of this brand is rather small they have a very positive total brand image. Therefore, even if you as a car advertiser would not reach that many of your target group the ones you do reach are more likely to attach positive attributes to you just because you chose to be there.

Conclusions

Some of the total brand image features not looked at in detail in this report may seem a bit low. One has to remember to interpret the results in context to how strong a feature each one of them is in the surveyed category. E.g. knowledge is not a feature that is generally attributed to magazines at all but is strong in news media and newspapers. Against that backdrop the result may not be that low after all. For a women’s magazine it is actually pretty good.

In our synopsis we said that it will be interesting to see how a traditional print magazine in a well established print house incorporates internet to really coin one brand of its two formats and finds new audiences on line. In this case we can state that they have succeeded very well. By not loosing the essence of the brand and concentrating on the features that most readily transfer to internet as a medium they have been able to create a total brand that is of the same root in both formats of the brand. The internet brand may have some catching up to do in terms of the strength of the image, but the shape is the same and that is a very good place to be. That also makes it easier for the media sales people, because they now can be sure that they are only selling one kind of an audience, regardless the numbers of eyes.

We consider it proven that our method can bring forth the strengths and possible shortcomings of a brand image. By examining brand image separately for each audience it is also possible to identify which medium is adding strength and which is decreasing the power of the brand.

In our synopsis we also said that we aim to show, that the time would have come for print media to truly embrace the the future and with the help of research claim their rightful position for their total brands in the media mix, be it through print or web format. Even though the adoption process is still in it’s early stages we can clearly say that it is not due to lack of suitable metrics if this result is not fully embraced.

We fully believe that it is easier to convince advertisers of the media environment’s suitability to their brand if you first can tell about your media’s brand image. By understanding the audience’s mood and feel media sales departments can more accurately predict which advertisers and advertisements will thrive in their media environment and thus create more success stories.