Peter Callius, TNS Sifo

Peter Masson, Bucknull & Masson

Worldwide Readership Research Symposium Valencia 2009 Session 5.7

In a multimedia environment comparability of the different media measurements comes to the fore since there are major differences in what constitutes advertising reach and an advertising OTS resulting from the way each medium is measured.

As a result the reach and frequency offered by one medium and another (for a given sum of money) may not be directly comparable and this will influence budget allocations.

Media owners should really consider the time and money spent on each media category to get the second decimal correct in their ‘currency’ research in relation to what is needed to insure that the media category is treated fairly in the media planners war room – where the war of the media weights will be increasingly raging.

The need for multimedia

The need for consumer centric multi media planning data has been described in numerous forums over the years.

As have the difficulties of achieving it technically and politically within the ‘silo’ approach in existing media ‘currency’ research.

World leading advertisers have advocated the need for integrated planning, for example in the Worldwide Multimedia Measurement conferences and in the World Federation of Advertisers Blueprint for consumer centric holistic measurement.

Media and advertising agencies have answered the call and have worked in 360˚ approaches to satisfy the need of advertisers.

Most of the 360˚ approaches have however not been research based since multimedia measurement databases in most instances have simply not existed.

To create more relevant industry surveys research agencies have tried to navigate the dangerous and shallow media waters but always having to look out for political and methodological as well as financial reefs, which can break the hull at any time.

In a number of countries, however, multimedia databases are now a fact. The solutions vary, depending on the situation in that particular country. In Sweden a working cross-media survey (Orvesto Consumer) and planning software (Sesame) have been in place for a number of years covering newspapers, magazines, TV, radio, Internet, Direct Mail and Cinema.

The Swedish solution

In Sweden therefore the “demands” from WFA’s Blue Print seem to be fairly well covered. In particular:

The Orvesto Consumer survey provides a full target group survey with 50,000 interviews yearly permitting even detailed target groups to be used.

The survey provides traditional AIR measures for newspapers and magazines but also records ‘single source’ a carefully developed set of questions about TV channel viewing, radio channel listening and internet site visiting. This set of questions enables the modelling of a week of (TV/Radio/Internet) behaviour for each respondent (at an average minute level by quarter hour by day throughout an average week) which matches the reach (and duplication) levels found the currency surveys. This process is known as VDiary creation and calibration1. The Sesame software model projects the data beyond the week so a planner can build and evaluate cross media schedules over any time period.

1 A better alternative to Fusion: A modeling procedure to simulate independent media ‘currencies’ by Peter Masson and Paul Sumner, Bucknull & Masson, London (WM3 2006 Shanghai)

The TV data is calibrated to the MMS PeopleMeter panel. The Radio data is calibrated to the TNS-Sifo Swedish Radio Survey (day after recall). The Internet data is calibrated to TNS- Sifo Web panel (passive cookie measurement)2.

Our preference is to organize all media exposure data into a diary/panel format and avoid the use of probability models. This would be a normal format for TV/radio/Internet data but we have now been able to realize this format for daily newspaper reading. TNS-Sifo also run a daily monitor of newspaper reading (Orvesto Day with 1000 web interviews daily3 which provide (when averaged over time) the average daily reach of dailies. We are then able, using the Orvesto Consumer (frequency) data, to create a one week reading diary for each respondent where the average day reach (from the summation of all respondents) matches the Orvesto AIR claims (the ‘currency’) and the day by relative reach levels match those from Orvesto Day..

From a planning point of view it is therefore possible to schedule an Internet ‘buy’ for the newspaper site on a Tuesday (or proportion of ‘hits’ thereof) and evaluate it in combination with the Tuesday readership of the printed paper.

It is the retention of the time line in the planning process and the ability to simply ‘count’ audience accumulation across media and across time that is the real advantage in the VDiary system. This is a much preferred method to the use of probability models to determine duplication and accumulation which are reliant on inappropriate ‘independence’ assumptions4.

Also the form of this data as an average week is most appropriate for forward planning. It is issued quarterly (TV, radio and newspapers) and monthly (Internet) enabling the planner to use the most appropriate diary for predicting the period to be planned.

Magazines and cinema, while probability data, are included within the data base and the software is able to combine the two sets of data (probability and diary).

Additionally there is an integrated Direct Mail planning and scheduling tool. Orvesto Consumer respondents report what they do with unaddressed direct mail when they receive it (a scale from read everything to dump everything immediately). It also establishes for multi-person households who opens the unaddressed mail and the degree to which it gets passed to the respondent. Based on these two questions we establish a probability of a piece of unaddressed mail being read by the respondent.

A planner may ‘drop’ X000 unaddressed mail pieces into households in a particular (set of) post code areas. We can then, within Orvesto Consumer asses the reach of households and of those respondents in the household and of course the profile of those respondents. A ‘drop’ (and multiple ‘drops’) selection may then be scheduled alongside any of the other media.

At the present time therefore the Orvesto Consumer base contains 7 media types that can be scheduled together (newspapers, magazines, TV, radio, Internet, Direct Mail and Cinema).

The only major media not fully included in the planning software is outdoor (a discussion with the outdoor companies and the Swedish Federation of Advertisers is ongoing – with the aim to also model outdoor in the Orvesto Consumer base.

New mixed media solutions lead to new challenges

Since a working multimedia model already exists in Sweden the focus has moved from creating the database to making the best use of the data.

This means that the focus nowadays is on planning. This raises new issues.

Comparability of the different media measurements comes to the fore since there are major differences in what constitutes advertising reach and an advertising OTS resulting from the way each medium is measured. As a result the reach and frequency offered by one medium and another (for a given sum of money) may not be directly comparable.

This is the issue that we will address in this paper. It is quite distinct from the second (and far more complex) issue of the ‘effect’ resulting from the ‘OT’ delivered by the different media.

2 Daily reach and beyond. Peter Callius and Anders Lithner, Research International. WRRS, Vienna 2007

3 Newspaper and magazine consumption off- and on line. A future printed in full colour or black and white? Peter Callius and Anders Lithner, Research International. WRRS, Prague 2005

4 Multi-Media Modelling by Dr. Paul Sumner and Peter Masson, Bucknull & Masson. (written paper for the WRRS, Cambridge, Massachusetts, 2003)

However even before these two issues there are organisational structure issues at most media agencies, which do not seem to support a full 360˚ tactical media planning reality. The issue is at least two sided. Firstly the lack of tactical cross-media planning structure means that the “project managers” who will be involved in strategic media category resource allocation might not have the tactical skills and knowledge of the different media categories.

On the other hand the people in the different media silos (TV department, Digital, Print etc) will not necessarily be skilled in the “art meets science” approach which is needed to compare the different media categories.

All in all – the absurd situation can arise that no one really has the responsibility (and maybe skill) to consider the relative OTS values between neither different media categories nor the complex issues surrounding effect.

But when multimedia databases exist the modification relatively of OTS values will all of a sudden turn into an extremely tactical and hands on decision. The individual decision from each planner can have large consequences for the individual media categories.

Because clearly in the different ‘currency’ measures not all Eye balls get the same opportunity to see the advertisement.

This leads us to the:

‘War of the Media Weights’.

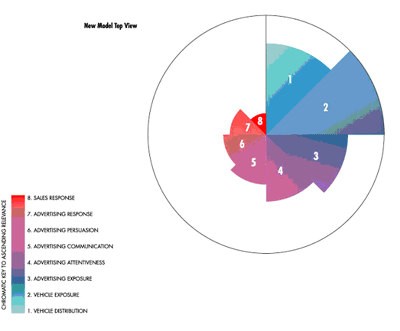

The ARF has provided a series of ‘steps’ for media evaluation metrics against which the media measurement of each media type can be assessed. We have developed a similar analysis (Table 1 below) to the point which can be considered the ‘responsibility’ of the medium. That is delivering the ad. in front of a (target) person who is paying attention to the medium.

The ARF steps go further than this to the point of advertising ‘effectiveness’ which involves other factors than the audience delivery of the medium – namely the ad. content, ad. relevance to the recipient and the ad. presentation (creative execution). We do not discuss these areas in this paper but our some of views on this area can be found in an ARF paper5.

Chart 1

5 Developing ‘Single source’ media data and applying it in multi-media schedule evaluation by Josephine Bucknull and Peter Masson Bucknull & Masson, UK (ARF October 2000 New York)

In table 1 below we layout 4 levels and track for each of the media what the OTS definition is at each level. Bold italic text indicates the normal ‘currency’ definition.

Table 1

Current reach definitions used by Orvesto Consumer or used by the ‘currency’ surveys to which the Orvesto data is calibrated

| Reach Deniniti n | Level | Dail

e spapers (recall) |

Mee l e spapers Magazines (recall) | M nth Magazines (recall) | TV (panel) | Ra i (recall) | lnternet (panel/mins) | lnternet ‘hit’ | na resse Direct Mail | y ster (recall r

Cinema sat trac ing) |

| Net Reach definition at ‘segment’ level. | 1 | Claim to see any part (including sections) of any issue in last issue period (=yesterday) | Claim to see any part oCf laim to see any part any issue in the last any issue in the last issue period (= in last issue period (= in last week). month). | oVf iewed at least one Claim to listen (for at consecutive minute least 5 minutes) during an average dayyesterday (= average (= yesterday) day) | Present on site for at least one consecutive minute yesterday ( = average day) | Respondents with at

least one browser ‘hit’ Мail shot delivered to Atttended a cinema Passed through yesterday (= average household on a given yesterday (= averagesteet/zone containing day) day day) site on a given day |

||||

| OTS/FD

Gross Reach definition |

1

excludesmutiple reading events (OTS) (notable exclusion) |

1 excludesm1utiple excludesmutiple reading events (OTS) reading events (OTS) (V. lmportant

(important exclusion) exclusion) |

1

No multiple viewing from one ad. |

1

No multiple viewing from one ad. |

1* repeats

lnclu esmultiple OTS |

1* repeats

lnclu esmultiple OTS |

1

excludesmutiple reading events (OTS) (Slight exclusion) |

1 1* repeats

No multiple viewing lncludesmultiple from one ad. viewing events (OTS) |

||

% who will visually pas%s who will visually pass% who will visually pass% Viewing any part of

an average page in an an average page in an an average page in an the commercial break i%n listening to any part o%f on same

% on same

% passing site meeting

standard visibiity criteria

Advertise-

ment opportunity

average issue (or

section thereof)

2 yesterday

average issue (or average issue (or which commercial is the 15 mimnute segmenstcreen/screen part to screen/screen part to % indviduals physically% individuals presenet .g. within 25m with a

section thereof) in lastsection thereof) in lastaired for at least one in which commercial is which the advertisemenwt hich the advertisemenrteceiving the mail shotsin a cinema screeninvgiewing angle of 2°5for

week

month

minute

aired.

is served.

is served.

delivered

the commercial a 16 sheet site.

and in a cinema available (i.e. not

screening the obscured by traffic or commercial people)

interference

interference

aired.

ad. screening

interference

interference

з interference

Presence

colour, position, colour, position, colour, position, % Claiming presence in15 minute segment in colour, position, motionc,olour, position, motion,

editorial and other ad.editorial and other ad. editorial and other ad. room during minute ofwhich the commercial isedit and other ad. editorial and other ad.

% individuals present

during the screening% passing site when of the commericals visibility potential is

% listening during an Ad visibility probability Ad visibility probability

average minute during abased on ad size, time, based on ad size, time,

Ad visibility probabilityAd visibility probabilityAd visibility probability

based on ad size, based on ad size, based on ad size,

medium 4 attention to medium attention to medium attention to medium to the TV set to the radio attention to medium attention to medium them commercial in

physically receving maial nd in a cinema

shots AND looking at screening the

browsing implies

% individuals present

during the screening of the commericals

% of individuals

Allowing for inaccurate

presence recording and

% paying full attention and paying full attentionbrowsing implies

reading implies

reading implies

Attention to reading implies

At level 4 OTS: (= open eyes and /ocussed on the medium when advertisement is on display) the recipient has the option to reject or read/listen/browse the advetisement

At this /leeting moment the ‘/orce’ o/ the medium, the content presentation and its relevance/interest to the recipient determines the degree the advertisement message is

Level 4 provides level of comparison where the measure for each medium provides for ‘eyes/ears focussed on the medium at the time the advertisement is on display’.

From a media owners point of view this is a measure of what he contracts to do – deliver (target) prospects in front of the advertisement where the target has attention focussed on the medium.

After this stage the dominant elements in creating effect are outside the control of the media owner (ad. presentation/content/relevance to recipient) although the medium can facilitate and enhance the communication process.

Let us go through the different media and see where, in the model, their OTS definition is currently place and what adjustment would be needed to bring it to level 4.

Print (Newspapers, weekly and monthly magazine)

The ‘currency’ measurement is level 1

Level 1 – Gross and Net Reach comparability

(In the ARF Model this would be Vehicle exposure)

For integrated reach and frequency analyses to be made (at any level) we need to insure comparability on TWO metrics. The first is at the Net Contact level (at least one OTS) and second at the Gross Contact level (total OTS and the frequency distribution (FD) of OTS).

In the case of TV, radio and Cinema the advertisement is only available to view at the time it is transmitted. There is no significant level of repeat exposure to it. The net audience and the Gross audience from 1 insert are identical and the average OTS (Gross/net = 1.00).

But for print, Internet and Poster the advertisement stays available (for the time period of purchase/life of the title) and it may get significant levels of repeat OTS and therefore (considerably) greater than 1.00.

In the case of Outdoor and Internet these repeat exposure are included in the ‘currency’ measure with each passage past a site recorded and ‘hits’ (number of minutes spent) reported for the period of the Internet purchase.

This is not the case for print (and Direct Mail) where repeat exposures are not measured. This is less significant for a newspaper than a magazine but still potentially important. Until magazines adopt a measurement system (e.g. like the WAR project6 in Belgium) which reports multiple reading events they will be significantly disadvantaged in terms of the underestimation of OTS frequency in any cross media analysis. The same issue applies to daily newspapers but since the life of the daily is essentially the day of publication it is much easier to measure and apply multiple reading events.

In addition to Gross and Net reach comparability the planner would need to estimate the Net and Gross contacts within a time context. That is the planner needs to know and control when his contacts are being delivered as this has a serious impact on the ‘effect’ that can be achieved. (Too few OTS in a given period may be ‘under-kill’ and too many may be ‘over-kill’).

Now it is again the magazine measurement that creates the problem for campaign evaluation within time periods. Magazines take time to build the reach the LIP (Last Issue Period) measure provides (up to 6 weeks for weeklies and 6 months for monthlies). The reach achieved within the first few days of a magazine’s life will be a fraction of the final. Consequently combined analysis where day by day or even week by week results are reported magazine Net Reach will be heavily overestimated (and so too the combined schedule).

A consequence of overestimation is a bit like “peeing in your pants on a cold winter day”. It feels warm and cosy at first but then it starts getting cold – for magazines it means that overestimation will likely give planners the wrong picture of the magazine schedules weight and buy less than they perhaps should have and they will fail to recognise that magazines are actually a frequency medium delivering OTS day by day, something very important in ‘recency’ planning.

Thus with the current methodologies it is not therefore possible to produce a comparable Net Reach definition at the day level across all media. Only at the week level or month level depending if monthlies are included. Further the Gross Reach level for magazines and to some extent dailies will be significantly underestimated as repeat exposures are excluded.

In the absence of specific data providing repeat reading estimates estimates could be introduced. Every respondent in the data base would need to be allocated a number of ‘pick-ups’ and Gross Reach and FD counted independently.

Note: A probability model has no way of separating the Gross estimate from the Net Reach calculation and cannot be used for this purpose since Gross reach is always a function of the single insertion net reach.

Level 2 – Advertisement opportunity

(In the ARF Model this would be Advertising exposure)

Exposure to the medium does not necessarily mean exposure to the advertisement carried within that medium and therefore the ‘probability’ of an ad. being seen will be different in each medium.

For print the LIP (Last Issue Period) measure reports those reading/looking at any part of the issue (sometimes for a minimum time). While this is the ‘currency’ measure (in bold italic on the table) not everyone is going to ‘pass’ the page on which the advertisement is positioned. We need to estimate what proportion of the readers will ‘pass’ an average page. This would provide an estimate of readers with an advertisement OTS, if one had bought the advertising on the basis of a ‘Run of paper’ positioning by the publisher.

Page traffic studies of course provide detailed movement through the pages of a title, however they are in the main, based on specific issues and small samples of readers (generally regular readers or subscribers who are easy to recruit). More useful for this purpose is the’ proportion of issue’ read question. Sifo Research International included this question in an extensive ‘Quality Reading Survey (QRS) in 2005 7 via the Web. Through a sophisticated ascription procedure the QRS data was integrated into Orvesto Consumer and Orvesto Naeringsliv (the business universe survey) so that reading qualities could be analysed directly in the ‘currency’ survey.

6 An improved method of collecting and processing readership data by Peter Masson and Dr. Paul Sumner, Bucknull & Masson. WRRS Prague 2006

7 Integrating additional data into Orvesto Cosumer (Swedish NRS) by Peter Masson, Bucknull and Masson and Peter Callius, Sifo Research International, WRRS Vienna 2007

Below is an example of the results from the proportion of issue read question.

Notable is that the proportion of issue read is strongly correlates to frequency of reading8. Regular readers claim a much higher proportion of issue read than infrequent readers and these differences should be taken into account in evaluating the advertisement opportunity:

Table 2

| % of issue read | Ny Teknik | Privat Affarer | Veckans Affarer |

| Infrequent rdrs | 55.9 | 61.0 | 60.3 |

| Medium rdrs | 70.0 | 64.4 | 62.7 |

| Regular rdrs | 81.4 | 72.9 | 77.0 |

| All readers | 73.3 | 70 | 63.3 |

However if specific premium positions are being planned/bought then average page exposure probability would need to be adjusted upwards.

A page 1 position would attract virtually 100% of the page traffic and probably 95% for page 3 and the back page and the differentiation by reading frequency would be very much less.

The application of such ‘proportion of issue read’ factors applies both between titles and between print and other media. However the physical entry of such values into the software system can be tedious for a busy planner especially if controlled within frequency of reading groups for many titles. For intra media we are considering entering the ‘proportion of issue read %’ into the software with an option to use (or not) the values (or modifications therefore) in the analysis. These could also be applied in cross media analysis but in practice we find for cross media comparison planners prefer to select to write in a ‘single’ value for all magazines or newspapers selected.

Level 3 – Presence at the advertisement.

(There is really no equivalent in the ARF model and it would probably be considered as to be part of Advertising exposure. We however feel that it is important to make differentiation between levels 3 and 2 and that by doing so formally it can give planners help to create a structure around the probability that an ad. is really seen).

If the advertisement is a whole page then average page audience (Level 2) would be the measure for advertising OTS. If the advertisement is less than a page (particularly in a newspaper) not all of those who ’pass’ the page will be ‘present at the advertisement’. There will therefore need to be a second ‘reduction’ factor. The size of this is dependent on the ‘competition’ that the ad. has on the page from other advertisements and from editorial. It can be argued that the more interesting the editorial the less ‘visible’ the advertising. Equally it can be argued that we (readers) all have remarkable peripheral vision and are able indentify an advertisement as relevant while primarily focussed on another (edit) section on the page and in a micro seond decide to reject or (later) read the advertisement. Such argument would tend to reduce the difference between level 2 and 3.

There is now a considerable body of work from eye tracking studies (in some cases linked to brain reactions) and from traditional reading and noting studies that provide insight into advertising viewing on the page or spread.

Level 4 – attention to the medium

(There is really no equivalent in the ARF Model since it moves up directly to Advertising attentiveness – we believe that to equate OTS definitions we also need to consider the ‘Attention to the Medium’, which is really as far as we can demand the media owner to deliver)

Level 4 demands that the measure includes an element that implies the readers/viewers are actually paying attention to the medium.

In the case of print the act of reading implies attention to the medium and, if this is interrupted, then the reader normally returns to where (s)he left off.

8 A new paradigm for measuring engagement. Ted D’Amico, Mediamark Research, Inc.

Television

The ‘currency’ measure is level 3

The traditional PeopleMeter system provides a measure of the individuals in panel homes who claim (by opting in and out as viewers on the People Meter) to be viewing at the minute at which the commercial was aired. The system is good but not perfect as panellists do not always report their short term (or even long term) exits from the room and may indeed be doing other things than paying attention to the medium even if in the room (level 4).

Many interesting but small scale studies have been conducted to indicate the extent of this problem using video or personal observation of the viewing behaviour. 9

This is also much more the case with ppm measurement where panellists may well remain in audio hearing distance but cannot see the screen (or the ppm remains in the room but they do not) or their attention may be involved on other activities.

Care should be taken in the use of recall data about normal behaviour in the commercial breaks. It many cases the claim to view ads may be as low as 30-40% but this is NOT a factor to be applied to a PeopleMeter rating which (because of the People Meter) will already reflect a considerable amount of this ‘loss’.

The incorrect application of weights in this way, both to PeopleMeter data or to data calibrated to PeopleMeter data at the minute level, will seriously damage the TV rating.

The Television OTS needs some adjustment but it should be only for reasons of incorrect people meter reporting or respondents were doing something that takes the attention completely away from the TV while still present in the room.

Radio

The ‘currency’ measure is basically level 2

The majority of radio listening research is on the basis of day after recall where respondents report listening by ¼ hour with a minimum number of minutes listened (at least 1, 5, 10, or all 15). The minimum number of minutes listened affects the reach definition.

Presence for all 15 minutes actually provides an estimate of the average minute Net reach. This is the Level 3 measure (advertisement opportunity) and is largely comparable to the TV level 3 measure. It is not necessarily Level 4 although recall provides some indication of focus on the medium during the period. However this is not totally convincing since Radio research respondents are generally asked their start and stop times of listening so they are not actually considering and reporting for every quarter individually.

Thus some reduction factor for level 4 would be required as for TV.

If the minimum number of minutes viewed in a quarter is less than 15 (and particularly at a level of 5 minutes or less) then the ¼ hr reach needs to be reduced to the ‘average minute’ to achieve Level 3 (and comparability with TV).

We can achieve this by observing if the respondent reported listening to other stations during the 15 minutes and if so ‘share’ the 15 minutes of viewing proportionately amongst the multiple stations listened to. We can also observe if the respondent was listening in the ¼ hr segment immediately before and after the segment in question and attribute minutes viewed on the basis of 50% if (s)he was not listening in one of the adjacent segments (assuming that they joined or left the segment half way through) and 1/3rd if not listening in either10.

With ppm data the ‘within audio range’ record is available at the minute by minute level and therefore the average minute rating (level 3) is available.

However it may be that only ¼ hour net reach data is released (in the data base) with a definition of listening (1+ minutes or 5+ minutes in the ¼ hr) (Level 2) which will need adjustment to compare to TV.

The recall data gives an indication, to a degree, that the respondent was focussed on the medium while the ppm data does not – only that the panellist was in ‘audio range’ so further adjustment is needed to get to level 4.

9 Watching People, Watching Television: How People Really Behave During Commercial Breaks Sheila Byfield Mindshare Worldwide, UK

10 Radio Zapping, Nick North, GfK Media Ltd. UK and Lex van Meurs, Intomart GfK,Netherllands. ESOMAR Radio Conference, Geneva June 2004.

Internet

In the case of TNS Sifo Internet panel data the ‘currency’ is at level 2

The data collection is panel based with a passive cookie measurement of sites browsed and available at the second by second level but published on the basis of quarter hour data by day for an average week in a month. For all respondents browsing in the

¼ hour period a count is made of the time on site from which we can establish an average minute ‘Internet rating’.

That is the number of people browsing during an average minute in the segment imposing on the Internet measure a requirement to be ‘present’ for a period of time (one minute as with TV) for an OTS to ‘occur’.

A second OTS ‘occurs’ if they are present for a second minute and so on.

For the site of a leading Swedish evening paper the average minutes browsing in the ¼ hour are around 3.5 minutes so that while the ¼ hour reach may be 1.9% the reach during any minute in the ¼ hr reach on average will be only 0.45%.

This ‘rating will need further adjustment with the same considerations as for a newspaper page to take it to level 3.

Internet is an enormously fragmented medium and to further add to the complexity not all sites are large enough (actually most are not) to release data on each part of the site. Even though all sub sites are monitored they might end up only in the aggregated total site data.

If this is the case the probability of ad. presence is a lot lower than if data existed for each of the individual sub sites. In effect when this is the case Internet could actually be seen as measuring its OTS on level one. A planner should then (as in print) apply a further weight factor. Site centric data could be used to find the appropriate weight for the probability of a certain sub site (relative to the total site).

The advertisement on the Internet page will also be competing with other editorial and advertising. Its size, position, colour and movement will determine ‘presence at the advertisement’. Many sites have pages that involve a lot of scrolling down and an ad placed below scroll would need further OTS adjustment.

Another possible reason for further down weighting of the Internet OTS is that it is quite possible that a panellist is present at a site but leaves the computer with the browser still open. Since the measurement system is cookie based there is no way of knowing whether the panellist is in front of the screen or not. In accordance to rules set by the Swedish advertising association the session will be open for 30 minutes and then it will be closed. It is in theory quite possible that a non present respondent gets OTS counts while not present or when he is doing something else on the computer. When a session is closed the panellist will not be attributed with 30 minutes of viewing but with the average time spent per session on the site.

While the Internet is bought in terms of numbers or proportion of available ‘hits’ we developed the time based ‘rating’ as the most suitable for cross media comparison.

We are, however, about to make the ‘hits’ data available. ‘Hits’ have no implied time element although in the TNS-Sifo site centric measurement they are actual ‘screen views’ i.e. they are not counted until the whole screen has been displayed.

Additionally many ‘hits’ may be technical where the browser connection is refreshed or very fleeting where the browser moves on rapidly to another site /sub-site. So there is no time framework within which to judge ‘presence at the advertisement’.

In both cases (like print) there is an assumption of ‘attention to the medium’ that takes it to level 4 if level 3 is achieved. This is probably more the case if we are examining a text page (where the internet would be classified as a lean forward media) rather than a web page with lots of streamed material (where internet would be classified as a lean backward media).

Unaddressed Direct mail.

The ‘currency’ measure is level 4

In the data collection we establish the probability of the respondent seeing the unaddressed mail in multi-person households where the respondent is not responsible for handling the incoming mail and secondly we establish the probability of the respondent opening and reading it when he gets to see it. So it is actually a level 4 measure being an advertisement exposure where the respondent claims to be paying attention to the medium.

The repeat exposure is missing. For example a brochure or booklet could be kept for further and more detailed reference at a later time. Gross reach will therefore be underestimated

Bur for Net Reach no further adjustment is therefore necessary

Cinema

The currency measure is level one.

The measure is (probability of) visiting any cinema yesterday. This probability has to be reduced to the probability of visiting a cinema that is showing the client’s advertisement. This can be achieved to a large extent by filtering by region/towns in which the ads are shown. Then by applying a fraction based on the proportion of seats represented by the share that the contractors/cinemas used have of total seating. This takes the measure to level 2.

Level 3 requires presence while the advertisement is displayed. That is we need to estimate (but better to ask in the questionnaire) what proportion of cinema attendees arrive before the ads. start to be screened.

Even then to get to level 4 we would need to establish if the cinemas concerned screen ads. with the lights down in order to be sure that attention was being paid to the screen (=medium).

Outdoor

The ‘currency’ measure is level 2

There are a number of approaches to outdoor measurement. For the purposes of this comparison we assume there has been a traffic study (based journey recall or satellite tracking) coupled to a site base where it is possible to establish the frequency of passage and direction past each site (type) for each sample/panel member and the transport mode of that passage. For example the site was a 48 sheet passed on foot, (or on bike, on bus, while driving etc.)

In some cases a probability of actually viewing the poster (as opposed to just passing it) is established between the poster and research contractor, in other cases all passages are treated a 1.00 OTS. But as ‘the poster is the advertisement’ we have to classify it as a level 2 measure.

But there are strong level 3 considerations. While the poster presents the ad continuously its visibility may not be available to the passer by. In many cases, particularly in urban areas and crowded pedestrian precincts it may be obstructed by vehicles and people.

And there are level 4 considerations. People do not go out to view posters, posters simple ’expose’ the advertisement to people as they pass. People may well be preoccupied talking to friends, controlling children, concentrating on driving. We need a lot more information on people’s circumstance as part of the poster passage information. Mobile eye tracking tests, while interesting, will not give this kind of people related information.

A survey amongst media planners

Thus when multimedia databases become an everyday working tool the issue of equating OTS definitions will cease to be a philosophical discussion on a strategic level and move into being a very tactical decision.

The decision on how to best equate the different definitions of OTS is, as the overview has shown, not an easy one but it will need to be handled everyday by (busy) planners with different experience and background.

We made a survey of the views of 11 very experienced senior Swedish media planners (no one had less than 10 years media planning experience). They were given the different media categories OTS definitions and were asked to make a judgment on the relative values needed to bring the different OTS definitions of 4 media into line. (TV, Radio, Print, Internet)

It became apparent that everyone was extremely interested in the subject but that most lacked any prior internal discussion (in the agency) on the matter. Everyone was also very humble about the difficulty of the task even though they all realised that it is only the first part of the difficult ‘art’ of cross media planning.

The relative order of the four media seems to be quite stable but the values especially on print and internet varied a lot. TV seems overall be perceived as the media with the best correlation to advertising exposure.

Table 3

| ABSOLUTE | TV | Radio | Internet | |

| Planner 1 | 80 | 60 | 60 | 40 |

| Planner 2 | 80 | 60 | 75 | 80 |

| Planner 3 | 90 | 65 | 40 | 55 |

| Planner 4 | 60 | 45 | 45 | 75 |

| Planner 5 | 80 | 50 | 80 | 65 |

| Planner 6 | 85 | 40 | 60 | 30 |

| Planner 7 | 100 | 65 | 55 | 70 |

| Planner 8 | 50 | 20 | 30 | 5 |

| Planner 9 | 80 | 30 | 60 | 40 |

| Planner 10 | 85 | 70 | 65 | 75 |

| Planner 11 | 80 | 60 | 70 | 90 |

| Average | 79 | 51 | 58 | 57 |

| Max | 100 | 70 | 80 | 90 |

| Min | 50 | 20 | 30 | 5 |

The absolute weight factors will have an effect on the possibilities and limitations on the achievable gross and net levels in each media.

Table 4

| INDEX | TV | Radio | Internet | |

| Planner 1 | 100 | 75 | 75 | 50 |

| Planner 2 | 100 | 75 | 94 | 100 |

| Planner 3 | 100 | 72 | 44 | 61 |

| Planner 4 | 100 | 75 | 75 | 125 |

| Planner 5 | 100 | 63 | 100 | 81 |

| Planner 6 | 100 | 47 | 71 | 35 |

| Planner 7 | 100 | 65 | 55 | 70 |

| Planner 8 | 100 | 40 | 60 | 10 |

| Planner 9 | 100 | 38 | 75 | 50 |

| Planner 10 | 100 | 82 | 76 | 88 |

| Planner 11 | 100 | 75 | 88 | 113 |

| Average | 100 | 63 | 73 | 67 |

| Max | 100 | 82 | 100 | 125 |

| Min | 100 | 38 | 44 | 10 |

The index values above indicate the relative value which will be considered when it comes to budget allocation between the different media categories.

Overall it would seem sensible for each media agency to have their own “point of view” document as a base for planners to add their own experience and judgement.

It also becomes quite obvious that the individual decisions made by the media planners will and can have a substantial impact on the different media categories and over which media owners have no control.

Media owners should really consider the time and money spent on each media category to get the second decimal correct in their ‘currency’ research in relation to what is needed to insure that the media category is treated fairly in the media planners war room – where the ‘war of the media weight’ will be increasingly raging.

To describe the potential outcome of differential weights we simulated a 100 GRP newspaper campaign and applied the 11 different planners’ weights. Below we see the consequences. The “who is planning your campaign” factor seem to be of monumental importance to any media owner.

Chart 2

Consequences of planners new weights on newspaper schedule – Net

80

69,4

59,4

56,6

53,8

50,8

47,7 47,7 47,7

44,5

37,7

34,1

26,5

70

60

50

40

30

20

10

0

Original Net definition

Highest value

Lowest value

The authors suggested OTS balancing weights

This is as in so many cases of media planning a subjective decision which is ultimately based on a mix of knowledge, experience and what we believe are justified assumptions.

We believe that creating an OTS definition structure as the one described in the paper will help buyers and sellers to create a framework around which the discussion can take place. Opinions will differ. As researchers it is important to stand neutral in the war of the media weights.

We, the authors, suggest the following weights ©

Table 5

| Issue r’ship | Ad. OTS | Ad. presence | attention to medium | |||

| Level | Unit | 1 | 2 | 3 | 4 | overall % |

| Daily Newspapers (bought ROP) Magazine (bought ROP)

TV (People meter panel Radio (5 minutes in 1/4 hr) Internet (minute ‘rating’) |

Full-page 1/1 pc 30′

30′ banner |

100

100 |

0,7

0.75 100 100 |

1

1 100 0.85 0.75 |

1

1 0.9 0.65 1 |

0.7

0.75 0.9 0.55 0.75 |

The arguments behind our weights are the following:

100 in the table represent the ‘currency’ measure which as discussed earlier occurs at different levels for different media.

Print: For both newspapers and magazines we must first exclude those who read the issue those not ‘passing’ the page displaying the advertisement.

Callius and Sandström11 however pointed out the difficulty to treat print media as one entity. Average page traffic figures ignore that the planner could be buying premium positions (relevant to the target group).

11 To create page traffic – The publishers responsibility Callius/Sandstrom Presented at: WRRS, Cambridge, Massachusetts – 2003

This was considered to be a larger problem for newspapers than for magazines. These page exposure judgements have to be made therefore in relation to the type of purchase, in this case Run of Paper. On the basis of known proportions of issue read data (for titles that we would be using in the campaign) we would propose 0.7 for daily newspapers and 0.75 for magazines.

No further level of adjustment is need for magazines nor newspapers to go to level 3 since we are buying a full page and to level 4 since in the reading event there is a presumption of ‘attention to the medium’. The overall magazine score is therefore 0.75 and 0.7.

‘But at the end of the day the planner needs to make a decision. We would strongly suggest that if he is to apply an APX score (which he should) to a newspaper, the APX score should not be weighted down as much as the average suggests. Because if the advertisement is placed in a favourable environment, probabilities due to selective perceptions and relevance are a lot higher that there will be open eyeballs in front of that page than the average would suggest. It is also worth noting that when the planner is weighting down AIR he should consider doing so using the frequency scale instead of on an average level.’ 12

We also have to remember that we cannot make any compensation for the exclusion of repeat reading in the print Gross OTS estimate. This is an obvious disadvantage to print media.

What could make us change the weight:

Different print media has different reading patterns due to size, composition, profile, clutter etc and a planner would need to make careful adjustments due to the given circumstances.

“as the volume of newspapers pages and sections grow readers will be more selective. But the correlation is not linear a five times bigger volume reduces pages opened with 20-25 %”13

For example a highly topical magazine has quite often an even page traffic curve. A newspaper with different supplements might on one hand have higher page traffic than the average (the proportion of the sport pages a sport interested person is reading) but on the other hand not all persons are interested in sport and might not even open the supplement.

We believe the variations in print weights should be quite modest 0,6 – 0,95.

Television:

The OTS definition is the one which is most closely linked to the advertising opportunity (Level 3) and therefore the reduction is the smallest, reflecting the estimated number of people who claim to be in the room but not actually paying attention to the medium (TV).

Please note that the OTS adjustment do not take clutter, position in break, zapping etc into account since that is already covered in the currency measurement. The adjustment factor proposed is 0.9%

What could make us change the weight:

The adjustment factor that we suggested could be seen as quite modest and it could be further adjusted if for example the commercial is placed between or in programs, which could force the planner to adjust it further with more distraction for the between program ad. placement.

We believe the variations in TV weights should be quite modest 0,8 – 0,95.

Radio:

We first have to consider the number of people who we ‘lose’ between the level 2 definition of the ‘at least 5 minutes’ in the quarter hour (used in the Swedish Radio ‘currency’) to get to the level 3 definition – presence at the minute the ad. is aired. We consider this to be a factor of 0.85%

While Radio generally speaking is not considered to be a zapping media (during commercial breaks) and radio listening streams seem to usually be quite long it would suggest initially a high level of attention to the medium.

However that level of attention is likely most influenced by place and time of listening. During daytime at work and home it can often be background especially music programmes, while in the car it will have much more attention. So it is quite difficult to create an overall average reduction to take it to level 4. Overall we think it needs quite a serious adjustment to Level 4 of .65.

12 To create page traffic – The publishers responsibility Callius/Sandstrom, WRRS, Cambridge. Massachusetts 2003

13 Reach of newspaper sections – Bronner, Niekerk, Brennecke WRRS 1997

We however also need to take into account the walking in and out of the radios proximity. We do believe that a good analysis of PPM data could help planners. On the other hand if PPM data is available it is little use apart from political reasons using any other definition than “commercial break”.

We however also need to take into account the walking in and out of the radios proximity. We do believe that a good analysis of PPM data could help planners. On the other hand if PPM data is available it is little use apart from political reasons using any other definition than “commercial break”.

What could make us change the weight:

In this case it most probably is a case of making a judgment out of: place of listening, time of day and program content which could influence attention. For example: In the car listening would probably be considered to be worth a higher weight than at work. Also program content (music vs talk) could heavily influence state of mind and attentiveness.

We believe the variations in radio weights should be somewhat more substantial 0,85 – 0,4.

Internet:

The internet currency measurement is at level 2 and like print we have to judge the proportion of those that browse the page that will ‘be present at the ad.’ during the ‘minute’ they are on page.

This is very dependent on the internet page layout and the ad type and content. In the case of Swedish newspaper Internet sites (like Aftonbladed.se) the layout of the editorial is in a vertical strip with big headlines and short body copy and with an ad. in immediate proximity of each editorial piece. Ad visibility is therefore very high. The editorial usually requires the reader to scroll down. Not all readers will continue though the whole scroll limiting the visibility of some of the ads. Nevertheless we consider ad. visibility (be present at the ad.) to be high in these circumstances. Here we would propose a factor of 0.75 to get to level 3 with no further reduction for level 4.

However other site page design may (compared to Aftonbladet) could be very much less effective in providing ad visibility. In this case we are referring to a site which measures and publishes data on the different sub sites – if a site only deliver data on an aggregated level the placement of the ad (where on the site) will be crucial and it might need serious further down weighting.

What could make us change the weight:

If the site is only publishing a total site result and the ad will be placed on a sub site a further down weighing (like in print) will be needed.

If the ad is placed below scroll it will also need further down weighing.

If the site has a suspiciously long time spent on the site – caution could be advised.

We believe the variations in Internet weights should be some what more substantial 0,9 – 0,4.

The impact on schedules from applying individual planner’s media weight.

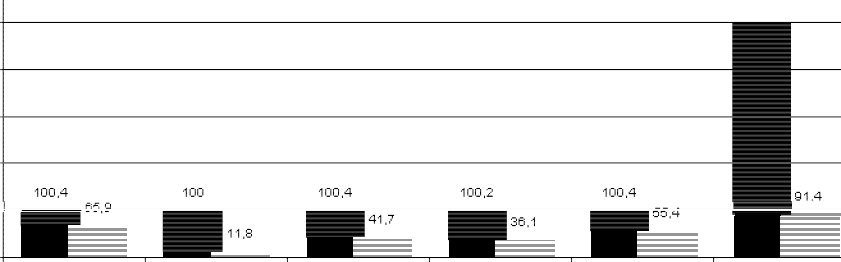

We built 100 GRP schedules in each of the 5 media groups that optimized 1+ Net Reach. We made the selection of individual vehicles within each medium as ‘normal’ as possible. In the case of Internet we used only the leading Swedish internet site (Aftonbladet.se) If we had chosen to optimize from a range of internet vehicles at this GRP level we would have ended up with a very small proportion of the inventory from each site that was not ‘buyable’ in reality.

The Gross and Net position without the application of any weight to balance OTS is shown for each of the media and all 5 in combination in the following Chart 3.

The Gross and Net position without the application of any weight to balance OTS is shown for each of the media and all 5 in combination in the following Chart 3.

It is interesting to see the large differences in the ability of the different media to produce net reach. Actually this is a first possible argument for multi-media scheduling – building target reach.

Newspapers are to a large degree local and produce the highest Net Reach. The ability to produce repeat exposures (apparent average OTS 1.5) is artificially limited as repeat reading is not included in the measure.

The same goes for magazines which produce the second highest reach but the fragmentation here is not based on location but primarily on interest and likewise the low average OTS (1.8) is a function of repeat reading being excluded from the measure.

In television planning one of the key problems is achieving a balanced distribution of OTS and not overweighting the heavy viewers (over-kill) and underweighting the light TV viewers (‘under-kill’). In this case while the overall reach is 41.7% and the average OTS is 2.4. The equivalent figures amongst heavy viewers are 48% Net reach and 3.0 OTS and amongst light viewers 30% Net Reach and 2.0 average OTS.

This is actually the second potential argument for adding additional media groups that give weight to the light TV viewer (like newspapers and magazines).

With internet, due to effectively the ‘continuous display’ of ads, OTS ‘clock up’ very quickly (average OTS 8.5 for the 11.8% Net Reach) – although (uniquely to the medium) it is possible to ‘cap’ OTS. This means that one sets a maximum level of ad. ‘servings’ to a particular browser in a given time period. The ‘hits’ are then served to alternative browsers thus pushing up net reach. This can only happen to the point where all browser ‘hits’ on the site have been used up in the time period.

When we look at the combined (5 media) schedule the net reach has increased from the highest single medium (newspapers) of 67% to over 91%. The average OTS is 5.5 and likely to be an underestimate as repeat OTS are not measured for Print.

In the following table we can see what happens with the application of the average weights provided by the planners

Table 6

| No weights | |||||||

| Unit | ADX

wght |

GRP | Net Reach | Cost SEK

m. |

cpt gross | cpt Index | |

| Newspapers | 1/2 pg c | 58 | 100 | 65.9 | 0.91m | 127 | 61 |

| Magazines | 1/1 pg c | 58 | 100 | 56.4 | 0.63m | 65 | 31 |

| TV | 30′ | 79 | 100 | 41.7 | 1.48m | 207 | 100 |

| Radio | 20′ | 51 | 100 | 36.1 | 0.70m | 98 | 47 |

| Internet | Banner | 57 | 100 | 11.8 | 0.11m | 16 | 8 |

| All media | 500 | 91.4 | 3.83m | 107 | 52 | ||

Table 7

| With average weights | |||||||

| Unit | ADX

wght |

GRP | Net Reach | Cost SEK

m. |

cpt gross | cpt Index | |

| Newspapers | 1/2 pg c | 58 | 58.2 | 45.2 | 0.91 | 219 | 84 |

| Magazines | 1/1 pg c | 58 | 58.2 | 39.9 | 0.63 | 151 | 58 |

| TV | 30′ | 79 | 79.3 | 37.9 | 1.48 | 261 | 100 |

| Radio | 20′ | 51 | 51.1 | 23.9 | 0.7 | 192 | 74 |

| Internet | Banner | 57 | 57 | 8.7 | 0.11 | 26 | 10 |

| All media | 303.8 | 78.6 | 3.83 | 176 | 67 | ||

GRP’s decline in direct proportion to the weight and in consequence the cpt increase also proportionately. For newspapers the estimated proportion of issue readers passing the advertisement (level 4) was estimated at 58%. GRP’s drop to 58 and the cpt rises from 127 to 219 (+72%).

All the inter-media cost relationships therefore change. The last column shows the index of cost (TV=100) between the media before and after the application of weights all media cpt move up in relation to TV especially print and radio which had the most severe weights.

The second notable point is that Net declines significantly less the weight fraction. For example the TV Gross weight reduction was 21% while the net reach reduction was 9% while the Internet reduction was 43% Gross and 26% Net.

Perhaps the most significant effect however is that the actual OTS delivery is not the 500 that the original ‘currency’ based estimates indicated but only the 304.

Chart 4.

Mixed schedule

600

501,4

303,9

-39

500

400

300

200

100

0

-100

Should there be a budget adjustment to achieve 500 level 4 advertising GRP’s?

Advertisers and agencies ‘judge’ that this given level of OTS are required to do ‘the job’ and those judgements have been built in the light of the ‘currency’ OTS and perhaps linked to ‘effect’ data like brand awareness. It is probable that is already an informal trade off through the mechanism of target OTS for the differences in OTS.

But the authors suspect and feel that this structured approach to balancing the OTS definition across the different media will lead to a better means to establish the link between OTS and ‘effect measures’. The other main issue is establishing such links is the time relationship between the OTS and the ‘effect’ measures. We need to be able to evaluate OTS by short time periods and as we have noted this is not possible with current magazines measurement.

It is also interesting to consider the consequences of putting an equated OTS definitions into media mix models, where we are trying to establish estimates for different Medias return on investment.

If a 100 Print GRP in reality is only 70 one way of interpreting the data is that print is achieving better effect than the original data showed. Another interpretation is that we should buy more print to balance the campaign and yet another is that print is relatively more expensive than the original OTS suggested.

How will introducing OTS balancing weights affect cross media decisions?

We are here working with the weights that we got from the planners and we are using each medium’s official prices. It is interesting to consider the different official prices of the different media compared to negotiated prices and the impact that weighted OTS definitions would have on these.

To give an indication of a cross media consequences we have developed 2 equal budget schedules. The first was a TV only schedule with a spend of 8m SEK over a 2 week campaign which achieved approximately 550GRP’s and a Net Reach of 64%.

The second was a TV print schedule where we reduced the TV schedule 1 by 200GRP’s and put the money into Press (about 20% of the overall budget). This produced 86% net reach and around 635 GRP’s

The Net Reach results without and with OTS balancing weights were as follows:

Table 8

| All | Light

TV |

Heavy

TV |

|||||||

| Net 1+ % | TV

only Sched 1 |

TV/ print Sched

2 |

Index | TV

only Sched 1 |

TV/ print

Sched 2 |

Index | TV

only Sched 1 |

TV/ print

Sched 2 |

Index |

| No weights | 63.7 | 86.1 | 135 | 47.1 | 79.7 | 169 | 73.6 | 88.9 | 121 |

| Weighted | 57 | 72.9 | 128 | 42.3 | 67.7 | 160 | 65 | 75 | 115 |

The addition of print adds to Net reach by 35% overall somewhat less when weighted (28%). But what the addition of print does particularly well is to add reach amongst light TV viewers. Prima facie there is a good added reach case for including Press (Daily Newspapers).

Table 9

| GRP’s All | Light

TV |

Heavy

TV |

|||||||

| No weights Weighted | 543.5

429.7 |

634

459.2 |

117

107 |

334.5

263.7 |

460.8

332.9 |

138

126 |

777.5

614.2 |

797.2

593.5 |

103

97 |

There is also a Gross improvement from the addition of Press as the cpt is lower. However this become marginal once the weights have been applied. Before weights there is a 17% increase in Gross but only 7% after weights are applied.

There are also notable changes in the OTS distribution pattern from the addition of Press titles (see table 10 below). Table 10

| NO weights | All | Light

TV |

Heavy TV | ||||||

| % of net 1+ with | TV

only Sched 1 |

TV/ print

Sched 2 |

Index | TV

only Sched 1 |

TV/ print

Sched 2 |

Index | TV only Sched 1 | TV/ print

Sched 2 |

Index |

| 1-5 OTS | 43.2 | 53.0 | 122 | 52.9 | 66.2 | 125 | 31.8 | 39.6 | 125 |

| 6-10 OTS | 27.8 | 23.6 | 85 | 25.9 | 19.6 | 76 | 27.6 | 27.2 | 99 |

| 11+ OTS | 28.9 | 23.5 | 81 | 21.2 | 14.2 | 67 | 40.6 | 33.2 | 82 |

Table 11

| Weighted | all | light

TV |

Heavy

TV |

||||||

| % of Net 1+ with | TV

only Sch 1 |

TV/Print Sch 2 | Index | TV

only Sch 1 |

TV/Print sch 2 | Index | TV only Sch 1 | TV/Print sch 2 | Index |

| 1-5 OTS | 60.3 | 66.5 | 110 | 65.7 | 75.7 | 115 | 52.6 | 57.0 | 108 |

| 6-10 OTS | 24.0 | 20.6 | 86 | 21.7 | 16.0 | 74 | 24.0 | 22.5 | 93 |

| 11+ OTS | 15.7 | 13.0 | 83 | 12.6 | 8.3 | 66 | 23.3 | 20.6 | 88 |

In the ‘no weights’ situation just under 30% of those reached received 11+ OTS from the TV only schedule, the application of weights cuts this by nearly half.

This is an important consideration as it may well be considered that 11+ OTS in a 14 day period is ‘over-kill’ but when level 4 OTS is defined then the ‘over-kill’ issue is much less. In schedule 2 with the addition of Press this 11+ group drops to 13% (of the higher net reach).

So the addition of weights significantly reduces the ‘imperative’ to add another medium (Press) to reduce ‘over-kill’.

In fact in this example the 25%of the market who are light TV viewers are in danger of ‘under-kill’ with 65% of the net reach receiving between 1 and 5 OTS in schedule 1 and this rises to 75.7% with the addition of Press in the schedule 2.

This is really an unexpected consequence of the planners’ quite large reduction of the TV OTS. The authors more moderate down weighing might actually, strange as it may sound, hasveproduced a larger imperative for print.

Conclusions on OTS balancing weights to level 4

Media group comparisons at the level 4 ad. exposure have different (and higher) cpt relationships. TV gains relatively in its cpt position. Below is an example of buying 100 GRP in each of the media – before and with the planners’ weights (Full page, 30 second spot and front page banner)

Chart 5

35000

29362

20337

17018

16128

14945

8698

6954

3554

687 1205

30000

25000

20000

15000

10000

5000

0

Cost per GRP New Cost per GRP

From our example Press can add significant reach to a TV schedule but less with the use of OTS balancing weights the planners suggested.

Obviously there will also be considerable positive synergy effects for those exposed to the two media – we do however not discuss this further in this paper.

The introduction of OTS balancing weights reduces higher levels on the FD disproportionately thus reducing the issue of ‘over- kill’ (from short period high GRP campaigns).

Adding Press to TV also works in the same direction which can then lead to ‘under-kill’ amongst light TV viewers. So the ‘imperative argument to add Press (to TV) is rather weakened.

However this example was based on all adults. Where special interest audience are involved are involved the Press and Magazines will in many cases be relatively more cost efficient to TV and their case for adding gross reach much stronger.

Also measurement models which include multiple reading events would help to bring the print OTS more in line with the measurement of other Media and seriously strengthens prints cross media position.

The planner will not draw final conclusions from the data so far presented since the effect (force) of the medium in the communication process has not been taken into account.

Nevertheless assuming the same media effect communication values balancing weight will definitely make it more difficult to argue for budget shifts from TV to Print at a mass market level (without a change in the cost structure).

An interesting further development should be the print media houses counterattack with ‘cheap’ Internet GRP’s. Most probably, only to be meet by a counter attack from the television media houses ‘cheap’ internet GRP’s And the war rages on.

But that our friends is another paper

References

Reach of newspaper sections – Bronner, Niekerk, Brennecke WRRS 1997 Counting Media Calories Erwin Ephron Ephron, Papazian & Ephron

A better alternative to Fusion: A modeling procedure to simulate independent media ‘currencies’ by Peter Masson and Paul Sumner, Bucknull & Masson, London (WM3 2006 Shanghai)

Daily reach and beyond. Peter Callius and Anders Lithner, Research International. WRRS, Vienna 2007

Developing ‘Single source’ media data and applying it in multi-media schedule evaluation by Josephine Bucknull and Peter Masson. Bucknull & Masson, UK (ARF October 2000 New York)

Newspaper and magazine consumption off- and on line. A future printed in full colour or black and white? Peter Callius and Anders Lithner, Research International. WRRS, Prague 2005

Multi-Media Modelling by Dr. Paul Sumner and Peter Masson, Bucknull & Masson. (written paper for the WRRS, Massachusetts – 2003)

An improved method of collecting and processing readership data by Peter Masson and Dr. Paul Sumner, Bucknull & Masson. WRRS Prague 2006

Integrating additional data into Orvesto Cosumer (Swedish NRS) by Peter Masson, Bucknull and Masson and Peter Callius, Sifo Research International, WRRS Vienna 2007

A new paradigm for measuring engagement. Ted D’Amico, Mediamark Research, Inc.

Watching People, Watching Television: How People Really Behave During Commercial Breaks Sheila Byfield Mindshare Worldwide, UK

Radio Zapping, Nick North, GfK Media Ltd. UK and Lex van Meurs, Intomart GfK,Netherllands. ESOMAR Radio Conference, Geneva June 2004.

To create page traffic – The publishers responsibility Callius/Sandstrom Presented at: WRRS Cambridge, Massachusetts – 2003